ABOUT US

Introduction

Japan Catalyst, Inc. was established as a member of Monex Group, Inc. with the mission of transforming Japan's capital markets and corporate sector. The business environment surrounding Japanese companies is constantly and rapidly evolving, requiring a mindset and adaptability that go beyond traditional management practices. At Japan Catalyst, we act as a catalyst for this transformation through strategic, long-term engagement, driving Japanese companies to accelerate their internal reform and enhance corporate value.

Our Purpose

At the core of Japan Catalyst's mission is to generate long-term investment returns for investors, including individual investors, recognizing them as the ultimate owners of companies. We act as a bridge between Japanese listed companies and their shareholders, focusing on sustainable, long-term corporate value creation that benefits all stakeholders. For listed companies, we support management reform through constructive dialogue and proposals, and for investors, we provide opportunities to deepen their understanding of the companies they invest in, delivering long-term, sustainable returns. We believe that these efforts will contribute to a more robust financial ecosystem in Japan and promote long-term corporate growth.

Investment Philosophy

We aim not only to invest in the gap between a company's intrinsic value and its market value (stock price), but also to ensure that our engagement acts as a catalyst to bridge this gap through our dialogues and proposals. By driving corporate governance reform and generating returns for our investors, we believe we can create a virtuous cycle in the investment chain, providing sustainable and meaningful value to society.

Our Uniqueness

Our team, all Japan-based investment professionals, possesses an in-depth understanding of the corporate sector, regulatory environment, and social structure, backed by decades of experience in Japan's business community and capital markets. Leveraging our extensive network and established presence in Japan, we engage directly with top corporate leaders from the early stages of our engagement process, driving transformative changes.

We employ a "constructive" approach to engagement based on trust and credibility, with strategic escalation when necessary to ensure impactful changes. Our constructive stance—neither friendly nor hostile— allows us to propose realistic and meaningful management reforms from a long-term perspective, delivering significant benefits to both capital markets and corporate management.

Our engagement extends beyond portfolio companies to involve all stakeholders, including the government, regulators, investors, and media. By advancing corporate governance reforms and promoting engagement investing as a social movement in Japan, we aim to contribute to the transformation of Japanese society for a better future.

Why Now

Japan’s corporate landscape has been undergoing significant transformation driven by ongoing corporate governance reforms since 2014.

These reforms are reshaping the mindset of both management and investors, resulting in an unprecedented level of pressure on corporate leaders from regulators and shareholders to improve governance. Japanese companies are beginning to understand the significance of these reforms and some are demonstrating a willingness and readiness to change.

However, for true corporate governance reform to be realized, this willingness must be translated into actual and effective change within companies, and investor engagement is critical.

Our strategy capitalizes on this shift by employing a constructive engagement approch that has proven increasingly effective in Japan’s unique market context. We leverage our unparalleled network and established local presence to drive these changes.

At Japan Catalyst, we aim to drive corporate reform within Japanese companies by embodying the principle of “Sottaku Doji” (a Zen saying that refers to the harmony of timely action and readiness). We act as a catalyst that transforms the company's willingness for change into tangible results.

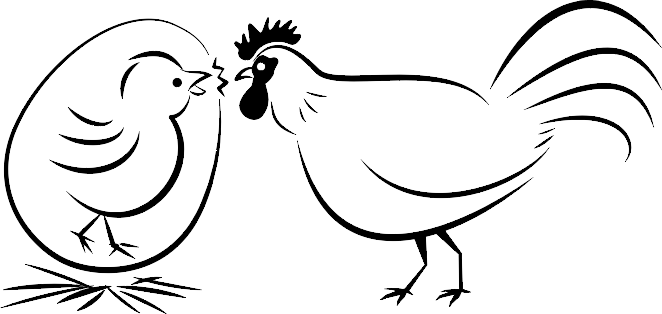

“啐啄同時(Sottaku Douji)” ~Zen saying~

Our ideal engagement style is “啐啄同時(Sottaku Douji)”

啐(Sotsu) is the sound made by the chic trying to break the eggshell from the inside to hatch. 啄(Taku) is the sound made by the mother bird trying to break the eggshell from the outside. 同時(Douji) means simultaneously.

Hence, the Zen saying “啐啄同時” (Sottaku Douji) implies that the chic can hatch if pecking from both sides works simultaneously.

Just as in corporate management, even if the mother bird pokes from the outside

or the chick pokes from the inside, the chick will only be safely hatched when both sides are

ready.

We believe the ideal form of engagement investment is offering an outside hand to support company

management when the company is trying to change.

Though the information provided on the Website is obtained or compiled from sources Japan Catalyst, Inc. (“JCI”) believes to be reliable, JCI does not guarantee the accuracy or completeness of such information. JCI and any of its affiliates shall not be liable for any loss or damage arising from the use of the information contained within the Website.

The Website has been prepared solely for the purpose of providing information. Information on the Website is not an offer to buy or sell or a solicitation of an offer to buy or sell any securities or other investment products.

The contents on the Website are the copyright of JCI. The use (including, without limitation, copying, modifying, reproducing in whole or in part, uploading, transmitting, distributing, licensing, selling and publishing) of any part of the contents without prior permission of JCI for commercial purposes is prohibited.